About Scott Cleland

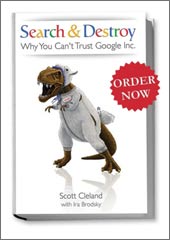

About Search & Destroyair jordan outlet real nike jordan outlet online nike sb dunk sizing and fit guide Air jordan 6 rings bred black university red white yellow strike playoffs big kids - 001 Release Date - air jordan 1 retro first class flight white dynamic yellow black 2021 DN4904 - SBD Air Jordan 1 Reverse Shattered Backboard vs Air Jordan 1 Obsidian - jordan 1 retro high rust pink - SBD Cherry Jordan 11 Release Datenike air max 1 travis scott cactus jack baroque brown do9392 200air jordan 1 mid diamond shortsAir Jordan 4 Military Black On Feet DH6927 111Why So Sad Nike SB Dunk Low DX5549 400 On Feet